Planning A Transition That Puts You In Control.

Choose From 3 Flexible Exit Planning Options Tailored To Your Business Stage.

Start with our Exit LITE sessions, a lighter touch & less complex introduction to the Exit Planning process. Or explore our full 5 stage, 21 Step framework.

From Insights to Impact

Begin with the end in mind

An Exit Plan is like a compass navigating your decisions.

Statistics suggest most business owners fail to spend any time on an Exit plan

but there are many ways to plan your exit & it's never too early to start.

Your Goals

Every business owner has their own story, motivations & reasons for considering an Exit. Knowing what is important to you are the first items we will discuss.

Having been through our own business exit & now operating as professional Exit advisors, be assured of our genuine empathy & experience of the Exit process.

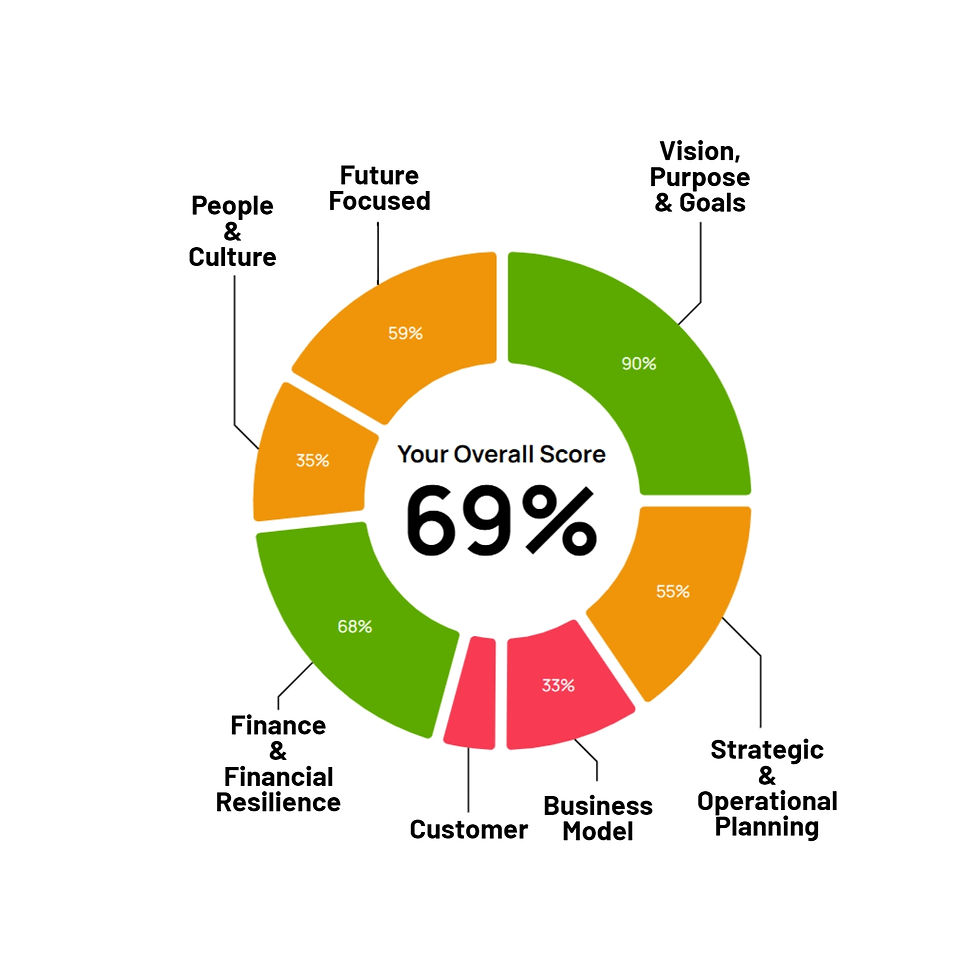

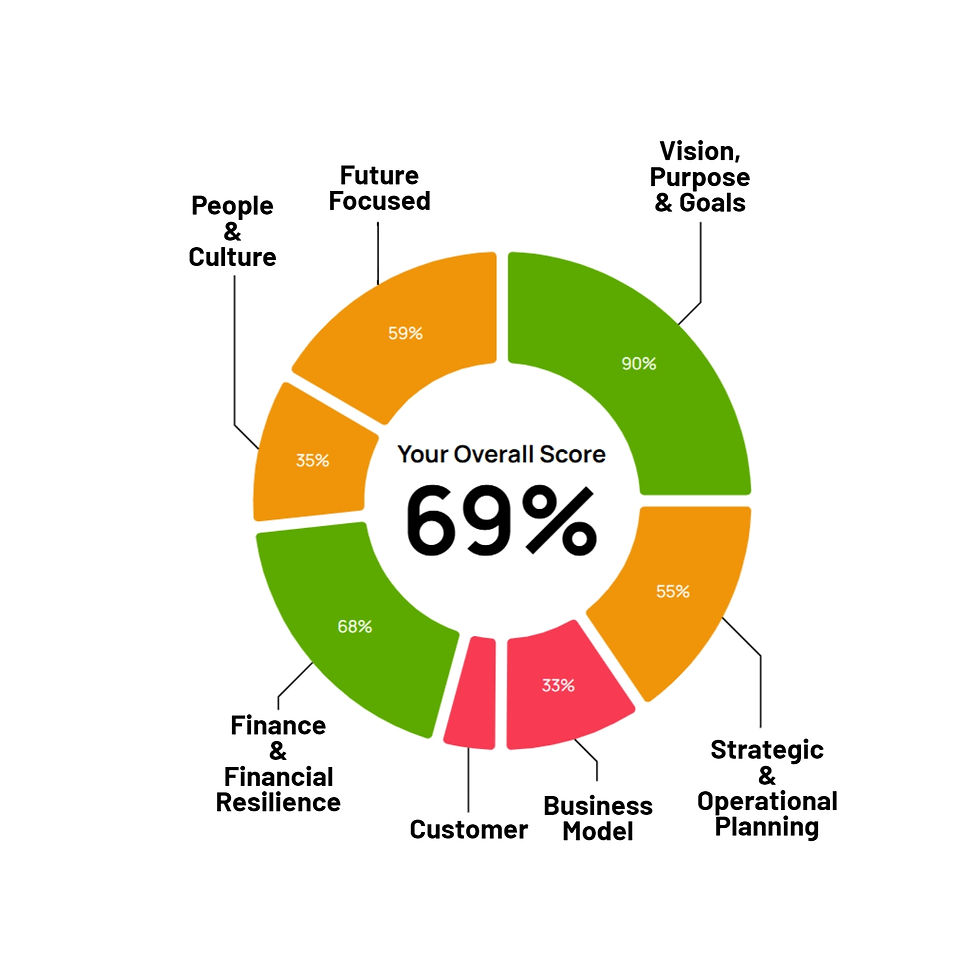

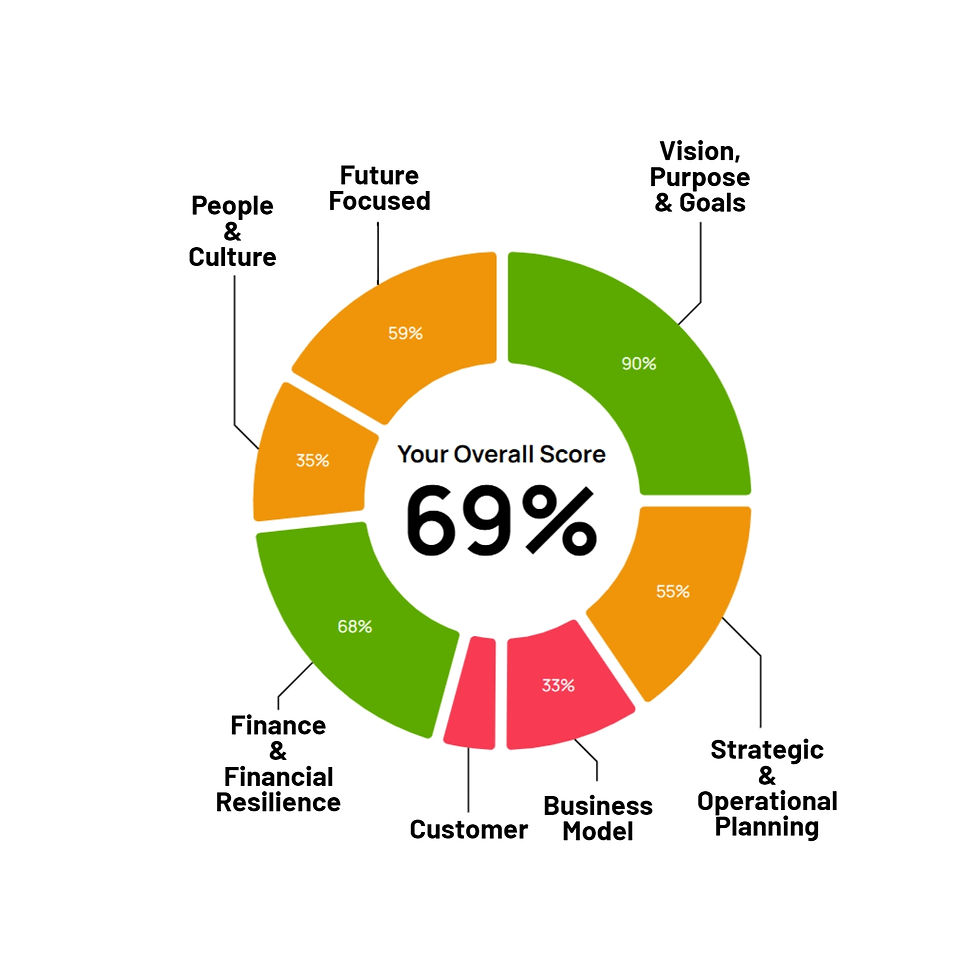

Business Assessments

A confidential deep dive discovery into your business, covering all tangible & intangible elements.

Benchmarking your business performance against the market, identify areas to improve to maximise future value. Learn how Growth tactics can improve exit plans.

Mapping the Exit Options

Mapping all exit options to determine the most suitable scenario for you & your business.

Assessing sale tactics, strategic buyers, transitioning to co-founder/s or staff & more. Whilst helping you confidently map, assess & engage brokers or M&A firms, to handle any transaction.

Design the Exit Plan

Working with you to design an achievable & realistic plan, controlling variables now to create the ideal situation when you eventually exit.

Avoid doing any deal out of desperation, with leverage to dictate your terms. Be inspired to take the next step.

"Having personally experienced the exit planning & trade sale of my own business, I truly appreciate how complex the process is for business owners. Since, moving into Professional Exit Planning advisory, we have observed a broad range of sale scenarios, challenges, tactics & solutions, across a diverse range of businesses".

Exit Planning frameworks designed & refined from hundreds of scenarios, including our own.

You will only sell your business once, so ensure you get it right.

As certified Exit advisors we will equip you with best practice Exit frameworks. Our process has been continually refined from over 600 exit case studies, internationally.

We draw upon a range of Exit Planning best practices, inc. our Exit Advisory certification with Capitaliz* Exit Planning, combined with our own direct Exit experience, selling our own firm through a strategic acquisition process.

Unlike general advisors & MBA consultants, our experience, having sat on both sides of the fence, assures you of a truly comprehensive, transparent & multi-disciplinary perspective. Read more on this here.

*Capitaliz* Exit Planning. One of worlds leading Exit Planning frameworks, a five stage, 21-Step process.

The M3 Framework

From Orange Kiwi

Whilst there are numerous frameworks, guidelines & opinions in the Exit Planning space, due to the unique nature of each & every business, a linear process is ill suited to Exit Planning.

Which is why we have found that the M3 Framework from Orange Kiwi, designed as a more dynamic & flexible approach, provides an excellent foundation through the entire Exit Planning journey.

The Exit Planning Journey Together

Goals Discovery

-

Owner/s &/or Leadership Goals (Inc. M3)

-

Timing & possible scenario feasibility

-

Ownership structures of business

-

Industry Benchmarking

-

Valuation eg current if any, models & options

-

Post Exit Vision / Plan (financial & non-financial)

-

Buyer, Broker / M&A Intermediary Preferences

-

Agree next steps (Now, Next, Later)

Recommendations

Business Assesments

-

Business model review

-

Analysis (Financial & Non-Financial)

-

Systems, Process & Technology

-

Sales & Marketing

-

Talent & Organisational Structure

-

Strategic planning & Operational execution

-

Growth & Value building opportunities

-

Competitor analysis & strategic acquirer opportunties

-

Business Assessment debrief, critique & suggestions

-

Growth & Value building opportunities

-

The Exit Options & possible scenarios

-

Valuation &/Transaction range/s

-

Corporate governance

-

Business Sale Priorities

-

Broker, M&A, Intermediary sourcing & assessments

-

S.M.A.R.T* Goals agreed *Simple Measurable Achievable Relevant Time Bound*

Execution

-

Exit plan options & plan confirmed

-

Valuation decisions (method, practioner, pricing, selection)

-

Accountabilities & KPIs appointed

-

Tax & Estate planning

-

Broker, M&A, Intermediary appointment

-

On-going observation, support & advisory

A first-class exit describes the sale of a company for a very high value, generally one that beats the expectations of the company's founders and investors and is well executed with a strategic approach.

It doesn’t necessarily mean selling at the maximum possible value, rather it is about the overall outcome for the company, shareholders and employees, including creating opportunities for growth, a smooth transaction and a successful transition process.

A first class exit requires that the transaction completes with the best acquirer, at the ideal time, with peak negotiating leverage, where you receive full consideration when it is due and are able to look back and be grateful for what you have achieved.

We will help you achieve a first class exit.

Best Value

Flexible Founder Clarity Sessions, from

375

For Owners Seeking Clarity.

Quick Wins & Actionable Insights.

Achievable Direction over 90 minutes.

Valid until canceled

A Sharp, 1:1 Strategic Session To Identify Priorities

High Level M3 Founder Discovery

Set 3, 6, 9, 12 Month Goals & Metrics

Focused On Growth, Value Creation & Acquisition Options

Actionable Recommendations You Can Apply Immediately

Best Value

Boosting Growth & Profitability, from

1 250

Every month

Our Most Popular Plan.

Build A Stronger, More Profitable & Valuable Business

Design A Strategic Growth Roadmap Tailored To Your Goals

Valid until canceled

M3 Founder Discovery Session

Diagnostic Across Operations, Financials & Value Drivers

6, 12, 18 Month Aspirational Metrics

Organisational Structure & Staff KPIs

Strategic Roadmap Tailored To Your Goals

Accountability & Ongoing Practical Support

Usually Two 90 Minute Sessions P/Month

Best Value

Exit Readiness (LITE), starting at

2 450

Every month

Designed For Owners Considering A Future Exit

Based On The 21 Steps Exit Framework

Maximise Value, Reduce Risk & Navigate A Successful Transition

Valid until canceled

The M3 Founder Discovery Session

Based On Our Exit LITE &/Or Shadow Exit Review

High Level Exit Readiness Assessment

Valuations - Appropriate Methodologies, Why, What & When

Identify & Extract Value Exercises

Value Improvement Action Plan

Next Steps Planning, Milestone Value Tracking & Reviews

Often Followed Later With Our 21 Steps Framework

Usually two 90 minute sessions p/month

Choose your pricing plan

Find one that works for you

Best Value

Flexible Founder Clarity Sessions, from

375

For Owners Seeking Clarity.

Quick Wins & Actionable Insights.

Achievable Direction over 90 minutes.

Valid until canceled

A Sharp, 1:1 Strategic Session To Identify Priorities

High Level M3 Founder Discovery

Set 3, 6, 9, 12 Month Goals & Metrics

Focused On Growth, Value Creation & Acquisition Options

Actionable Recommendations You Can Apply Immediately

Best Value

Boosting Growth & Profitability, from

1 250

Every month

Our Most Popular Plan.

Build A Stronger, More Profitable & Valuable Business

Design A Strategic Growth Roadmap Tailored To Your Goals

Valid until canceled

M3 Founder Discovery Session

Diagnostic Across Operations, Financials & Value Drivers

6, 12, 18 Month Aspirational Metrics

Organisational Structure & Staff KPIs

Strategic Roadmap Tailored To Your Goals

Accountability & Ongoing Practical Support

Usually Two 90 Minute Sessions P/Month

Best Value

Exit Readiness (LITE), starting at

2 450

Every month

Designed For Owners Considering A Future Exit

Based On The 21 Steps Exit Framework

Maximise Value, Reduce Risk & Navigate A Successful Transition

Valid until canceled

The M3 Founder Discovery Session

Based On Our Exit LITE &/Or Shadow Exit Review

High Level Exit Readiness Assessment

Valuations - Appropriate Methodologies, Why, What & When

Identify & Extract Value Exercises

Value Improvement Action Plan

Next Steps Planning, Milestone Value Tracking & Reviews

Often Followed Later With Our 21 Steps Framework

Usually two 90 minute sessions p/month

Choose your pricing plan

Find one that works for you

Best Value

Flexible Founder Clarity Sessions, from

375

For Owners Seeking Clarity.

Quick Wins & Actionable Insights.

Achievable Direction over 90 minutes.

Valid until canceled

A Sharp, 1:1 Strategic Session To Identify Priorities

High Level M3 Founder Discovery

Set 3, 6, 9, 12 Month Goals & Metrics

Focused On Growth, Value Creation & Acquisition Options

Actionable Recommendations You Can Apply Immediately

Best Value

Boosting Growth & Profitability, from

1 250

Every month

Our Most Popular Plan.

Build A Stronger, More Profitable & Valuable Business

Design A Strategic Growth Roadmap Tailored To Your Goals

Valid until canceled

M3 Founder Discovery Session

Diagnostic Across Operations, Financials & Value Drivers

6, 12, 18 Month Aspirational Metrics

Organisational Structure & Staff KPIs

Strategic Roadmap Tailored To Your Goals

Accountability & Ongoing Practical Support

Usually Two 90 Minute Sessions P/Month

Best Value

Exit Readiness (LITE), starting at

2 450

Every month

Designed For Owners Considering A Future Exit

Based On The 21 Steps Exit Framework

Maximise Value, Reduce Risk & Navigate A Successful Transition

Valid until canceled

The M3 Founder Discovery Session

Based On Our Exit LITE &/Or Shadow Exit Review

High Level Exit Readiness Assessment

Valuations - Appropriate Methodologies, Why, What & When

Identify & Extract Value Exercises

Value Improvement Action Plan

Next Steps Planning, Milestone Value Tracking & Reviews

Often Followed Later With Our 21 Steps Framework

Usually two 90 minute sessions p/month

Choose your pricing plan

Find one that works for you

Growth Strategists

Certified Exit Advisors

Business Sale Experts